Risk management in stock trading is a critical process that involves identifying, evaluating, and prioritizing potential risks to minimize their impact on investment portfolios. Traders must implement effective risk management strategies to safeguard their capital and enhance their chances of long-term success in the stock market. Understanding various risk types, including market risk, liquidity risk,…

Category: Blog

Fundamental Analysis- Do you need it?

Fundamental analysis is a comprehensive approach to evaluating the intrinsic value of stocks and securities. This method examines various economic, financial, qualitative, and quantitative factors to determine a company’s true worth. Analysts scrutinize financial statements, assess management competence, identify competitive advantages, and study industry trends to form a holistic view of a company’s value. The…

Is Using Trading Simulators Worth it?

Trading simulators are software applications that enable individuals to practice trading in a simulated environment replicating the real stock market. These programs provide users with a virtual account balance and real-time market data, allowing them to execute trades without risking actual capital. Both novice and experienced traders utilize trading simulators as a risk-free method to…

Technical Analysis- You need to know

Technical analysis is a methodology employed to assess and forecast future price movements of financial instruments, including stocks, currencies, commodities, and market indices. This approach relies on historical price data and trading volume, operating under the premise that past price patterns tend to recur and can be utilized to inform trading decisions. Practitioners of technical…

Swing Trading- What is it?

Swing trading is a financial market strategy that involves holding positions for short periods, typically ranging from a few days to several weeks. This approach aims to capitalize on short-term price fluctuations, taking advantage of market volatility. Unlike day trading, which requires constant market monitoring, swing trading offers more flexibility for traders with other commitments….

Day Trading- Is it for you?

Day trading is a form of financial market participation where traders execute multiple buy and sell transactions within a single trading day. This strategy involves closing all positions before the market closes, ensuring no trades are held overnight. Practitioners typically focus on liquid assets such as stocks, currencies, options, or futures contracts. The primary objective…

The Challenge of Day Trading: Why it’s so Tough

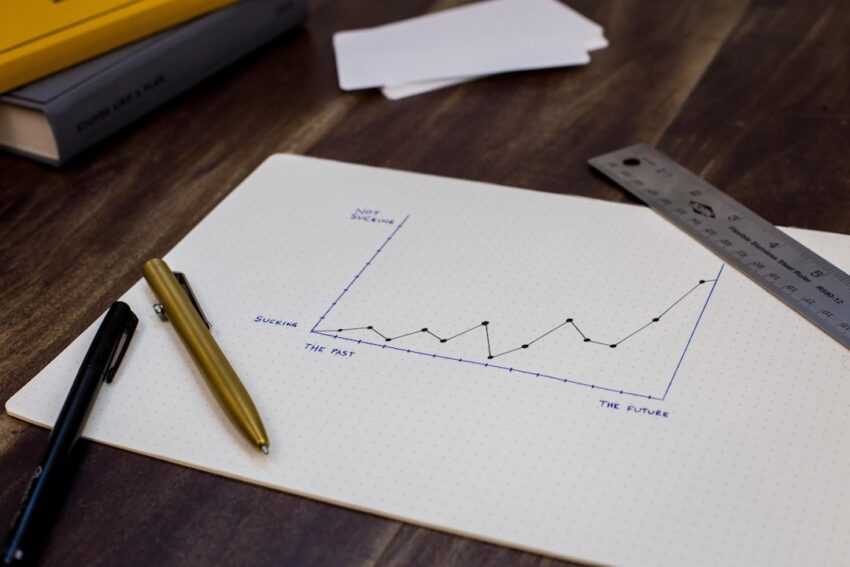

Market volatility refers to the degree of variation in trading prices over time. It measures the fluctuation in the price of securities, commodities, or market indices. Understanding market volatility is essential for investors and traders, as it significantly influences investment decisions. Various factors can cause volatility, including economic indicators, geopolitical events, company earnings reports, and…

Stock Trading Strategies – You Should at Least be Familiar With

Stock trading involves buying and selling shares of publicly traded companies on stock exchanges. It is a common investment method for individuals and institutions seeking potential returns in financial markets. Investors typically use brokerage accounts to execute buy and sell orders for stocks. Various stock trading strategies exist, including: 1. Fundamental analysis 2. Technical analysis…

Stock Trading Basics Made Easy

The stock market is a complex and dynamic system where shares of publicly traded companies are bought and sold. It is a marketplace where investors can buy ownership in companies, and in return, the companies can raise capital to fund their operations and growth. The stock market is often seen as a barometer of the…

Why do you need 25,000 to be a Day Trader

Meeting Margin Requirements Having sufficient capital allows day traders to meet margin requirements set by brokerage firms and regulatory bodies. Margin requirements dictate the minimum amount of capital that a trader must have in their account in order to trade on margin. Trading on margin allows traders to leverage their positions, meaning they can control…